Investing in Melbourne real estate has never been more enticing. Imagine this: You’re standing at the edge of a bustling city, where pristine beaches meet a vibrant cultural scene. The sun casts a warm glow on the skyline of Australia’s most livable city. As you take it all in, a question arises: Is it possible to experience this vibrant city while also securing a profitable investment?

Whether you’re a seasoned investor or just starting out, we’ll address the pain points and provide you with an informative guide to help you make informed decisions. Join us as we unlock the secrets behind Melbourne’s real estate market and discover why it’s an investment opportunity you won’t want to miss.

1- Exploring Melbourne’s Real Estate Market Performance

Melbourne has been seeing a lot of growth lately, and there’s a lot of potential for investment in its real estate market.

Melbourne’s housing market, which experienced significant growth from 2020 to 2021, has now experienced a decline of 9.1% from its peak in February 2022, following a period of remarkable growth with an increase of 17.3%.

It is evident that the housing market in Melbourne has experienced a notable shift.

- According to Corelogic’s daily home value index, data indicates that house prices in Melbourne experienced a 0.7% increase in June 2023.

- According to Proptrack, the home prices in Melbourne experienced a 0.2% increase in June, resulting in a total rise of 0.8% from their lowest point in January of this year.

- According to the My Housing Market report by Dr. Andrew Wilson, the housing prices in Melbourne experienced a 0.7% increase in June, while the prices of units in Melbourne rose by 0.6% during the same period.

So, if you are planning to invest in the Australian Market, Melbourne is a suitable option. We’ll love to help you make your financial decisions, connect with us any time.

2- Infrastructure Projects and Their Influence on Real Estate

In today’s real estate market, there are a number of infrastructure projects that have a big impact on the market. One of these projects is the Melbourne Metro. The Melbourne Metro is a massive project that will connect the CBD with the airport. This project is expected to have a huge impact on the real estate market in Melbourne. Another infrastructure project that has a big impact on the Melbourne real estate market is the Victoria Crossroads Project.

This project is expected to improve road and transport connectivity in Melbourne. Both of these projects are expected to have a big impact on the market, and it is important to keep track of their progress so you can make informed decisions about whether or not to invest in Melbourne real estate.

3- Population Trends and Migration Patterns

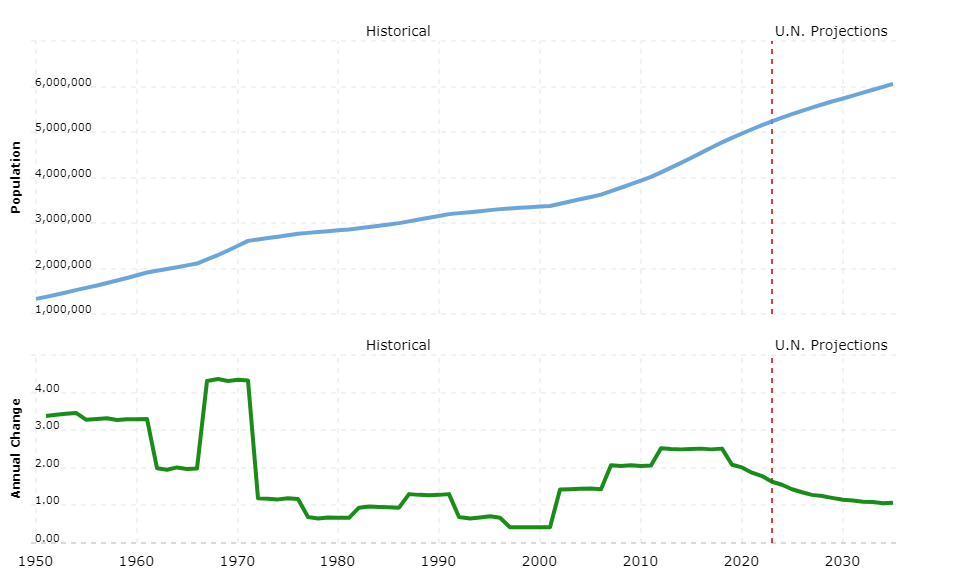

Melbourne is a prime destination for real estate investment, and it has been for the past decade.The current metro area population of Melbourne in 2023 is 5,235,000, a 1.63% increase from 2022. Following shows the population trends in Melbourne:

The population of Melbourne has been on the rise, and so has the demand for real estate. This has led to an increase in the value of real estate in Melbourne, as well as an increase in the number of properties available for purchase.

Melbourne’s infrastructure projects, such as the Melbourne Metro Rail Project and the Melbourne Airport Rail Link, are also supporting the growth of the city. The city has also seen a significant influx of people over the past decade, which has led to an increase in the number of vacancies and the demand for rental properties.

All of these factors make Melbourne an attractive place to invest in real estate.

4- Affordability in Melbourne’s Real Estate Market

Melbourne’s real estate market is incredibly affordable when compared to other major cities around the world. For example, the median house price in Sydney is AUD$1,078,000, while in Melbourne it is only AUD$600,000.

Furthermore, Melbourne’s real estate market is growing rapidly and is projected a house price is projected to reach around 6 million dollars by 2050. This growth is due to a number of factors, including an increase in population, infrastructure projects, and migration.

So if you are looking to invest in Melbourne’s real estate market, now is the time to do so. You will be able to achieve great returns on your investment over the long term, and you will be able to live in a beautiful city while doing so.

5- Supply and Demand Dynamics in Melbourne’s Real Estate

Melbourne has seen a lot of growth over the past decade, and with that, a corresponding increase in real estate prices. Melbourne has long been predicted to overtake Sydney, and is estimated to take the crown of Australia’s most populous city on that measure by 2031-32.

Along with this influx of people, there has been an increase in infrastructure projects, such as new hospitals and train stations. This has led to high demand for Melbourne real estate, and as a result, prices have been on the rise.

While there are a variety of suburbs that are available for purchase, some of the most popular include Collingwood, Richmond, and South Yarra. Melbourne is also quite accessible by public transportation, making it a great place to live if you are looking for an urban setting.

Conclusion

In conclusion, investing in Melbourne’s real estate market holds immense potential for both seasoned investors and newcomers alike. Over the past decade, the market has demonstrated a robust performance, with consistent growth in property values. This upward trajectory can be attributed to several key factors. Firstly, Melbourne’s infrastructure projects have been a game-changer, enhancing the city’s liveability and attracting both local and international buyers. Additionally, the city’s population trends and migration patterns indicate a steady increase in demand for housing, further driving up property prices. Furthermore, the current vacancy rates in Melbourne are relatively low, indicating a strong demand for rental properties. This presents an excellent opportunity for investors seeking to generate passive income through rental yields. Connect with us at David Willards Group to know more. Happy Investing!